L&T Finance Ltd. (LTF), one of the leading diversified retail Non-Banking Financial Companies (NBFCs) in the country, has been at the forefront of financial services for over three decades. Headquartered in Mumbai, the company has been rated ‘AAA’ - the highest credit rating for NBFCs — by four leading rating agencies. With granular and extensive pan-India presence across two lakh villages and 100+ cities/towns, the company is a trusted partner for millions of Indians, delivering customer-centric solutions that cater to a wide range of financial needs. LTF is focused on creating a top-class, digitally-enabled, retail finance company as part of L&T’s Lakshya 2026 plan and is positioning itself as a digital-first, digital-native lender.

This digital transformation builds upon its established market dominance in key product areas developed over a decade, including Rural Group Loans and Micro Finance (JLG), Farm Equipment Finance, and Two-Wheeler Finance. Furthermore, the company has garnered leadership scores, ratings and awards for its sustainability performance and CSR initiatives and is certified as a Great Place To Work®. With a large customer base of ~2.6 crore individuals and a robust portfolio mix spanning rural and urban businesses, LTF demonstrates its commitment to digital financial inclusion and is empowering communities across the country. This is made possible by a team of over 36,000 employees, comprising industry experts and passionate professionals, dedicated to crafting exceptional customer experiences that seamlessly address evolving financial needs.

Vision

LTF to transform into a risk-first, tech-first, strong growth oriented diversified financial services.

Lakshya 2026 goals vs achievement in FY25

To be a top-class, digitally-enabled, retail finance company moving from a ‘product-focused’ to a ‘customer-focused’ approach

|

Particulars |

Lakshya 2026 Goals |

Achievements for FY25 |

|---|---|---|

|

Retailisation |

>95% |

97% |

|

Retail Growth |

>25% CAGR |

Q4FY22 - Q4FY25: 28% |

|

Consolidated Asset Quality |

GS3 <3% |

GS3 at 3.29% |

|

NS3 <1% |

NS3 at 0.97% |

|

|

Consolidated RoA |

2.8% - 3% |

2.44% |

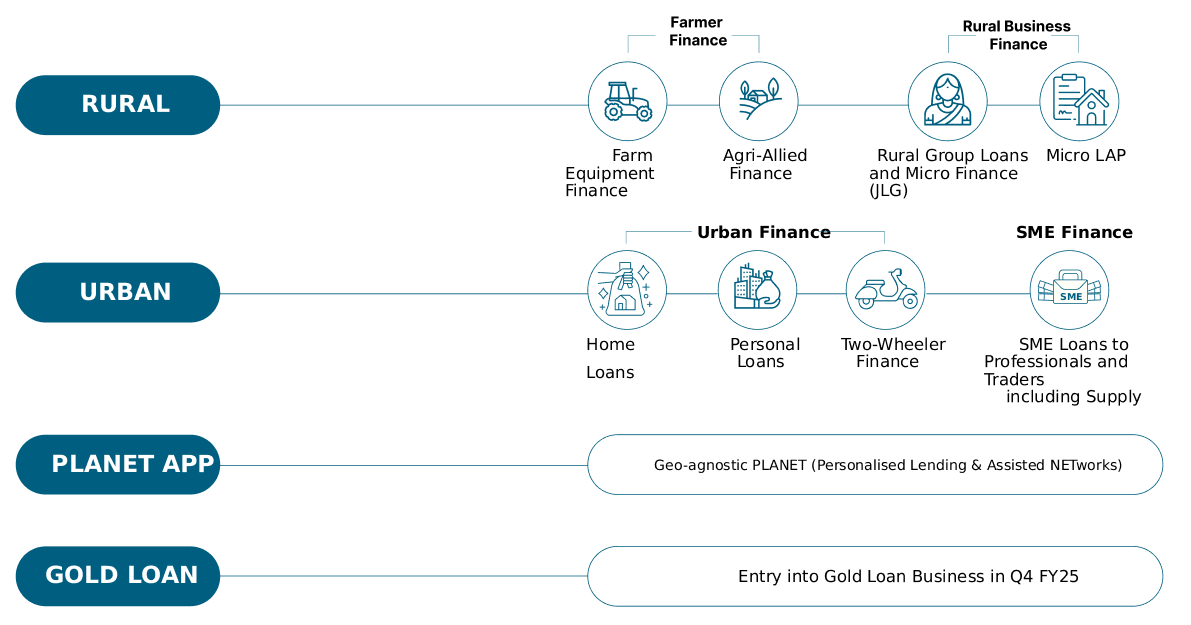

Key Offerings

Snapshot

-

~2,00,000 Villages, 100+ Cities / Towns Pan-India presence

-

13,000+ Distribution touchpoints

-

~2.6 Crore Customer database

-

36,521 Total Employee Headcount

FY 2025 – Laying the foundation for sustainable and predictable growth

- All-time-high consol. PAT of ₹2,644 Crore, registering 14% Year-on-Year (YoY) growth

- Strong retail franchise with a Retail Book Size of ₹95,180 Crore, up 19% YoY

- Retail disbursements stood at ₹60,040 Crore, up 11% YoY

Key Achievements

- Celebrated three decades of successful operations

- Announced LTF’s foray into the gold loan business

- Launched ‘Project Cyclops’, an inhouse-developed AI-driven, next-gen digital credit engine

- Pioneered AI-driven solutions such as ‘Knowledgeable AI’ (KAI), a virtual home loan advisor and ‘Lifestyle Index Calculator’, which optimises data collection

- Sealed partnerships with key fintechs like CRED, Amazon Pay, and PhonePe to offer credit products

- Launched the inaugural edition of RAISE’ 24, an event that convened around 4,500 participants, including influential regulatory leaders, innovative unicorn startups, pioneering deep tech firms, and key media representatives

- Onboarded Indian cricketer Jasprit Bumrah as the Company’s brand ambassador. Amplified brand-building framework through impactful Integrated Marketing Campaigns such as ‘The Complete Home Loan’, Business Loan, Personal Loan amongst others

- Launched PLANET App 3.0 and redesigned its corporate website to offer a differentiated Direct2Consumer experience

- Earned the prestigious Great Place To Work® (GPTW) Certification™

Rural Business Finance

- Book size up 6% to ₹26,320 Crore vs ₹24,716 Crore YoY

- A risk calibrated disbursement strategy was followed in the business owing to a fluid sectoral credit environment

Farmer Finance

- Book size up 10% to ₹15,219 Crore vs ₹13,892 Crore YoY

- Double digit growth showcased by the segment aided by a better than average monsoon and improving rural liquidity

Urban Finance

- Book size up 27% to ₹45,897 Crore vs ₹36,089 Crore YoY

- Driven by better customer profiling through ‘Project Cyclops’ and channel risk calibration for Two-wheeler loan, big tech partnerships and tapping growth in prime segments for Personal Loans, and newer partnerships and strong network of distribution channels for Housing Loan and Loan Against Property Business

SME Finance

- Book size up 67% to ₹6,524 Crore vs ₹3,905 Crore YoY

- Growth in the segment aided through increase in direct sourcing and existing strong network of distribution channels

ESG@LTF

- Performed in top decile in the FBN Diversified Financial Services and Capital Markets Industry in the S&P Global Corporate Sustainability Assessment

- ESG Risk Rating of 16.1 assessed by Sustainalytics continued to be in the ‘Low Risk’ category of experiencing material financial impacts from ESG Factors*

- MSCI ESG Rating of 'A'

CSR@LTF

- Over 13.5 lakh community members outreached under Digital Sakhi project across 7 States, 15 districts, and 2,800+ villages

- Over 2.30 lakh rural women sensitized on digital and financial literacy through the cadre of trained 1,110 Digital Sakhis

- Over 1 lakh horticulture plantation completed in 250+ acres of land in Karnataka under Project Prakruti

- Over 1.33 lakh flood affected community members supported under disaster relief in Bihar, Uttar Pradesh, and Telangana